90016 Income Property Market Report- Fall 2025

The 90016 zip code is a central Los Angeles market known for its historic character, strong rental demand, and growing investor interest. It covers neighborhoods such as Mid City, Arlington Heights, Jefferson Park, Lafayette Square, and West Adams. With its tree-lined streets, classic architecture, and proximity to employment hubs, 90016 has become an attractive area for multifamily buyers seeking both stability and long-term upside.

A portion of 90016 also falls within a designated Opportunity Zone, offering significant tax benefits for investors who structure deals through a Qualified Opportunity Fund. These incentives, combined with ongoing redevelopment and neighborhood growth, make the area particularly appealing to investors looking to enhance both cash flow and appreciation.

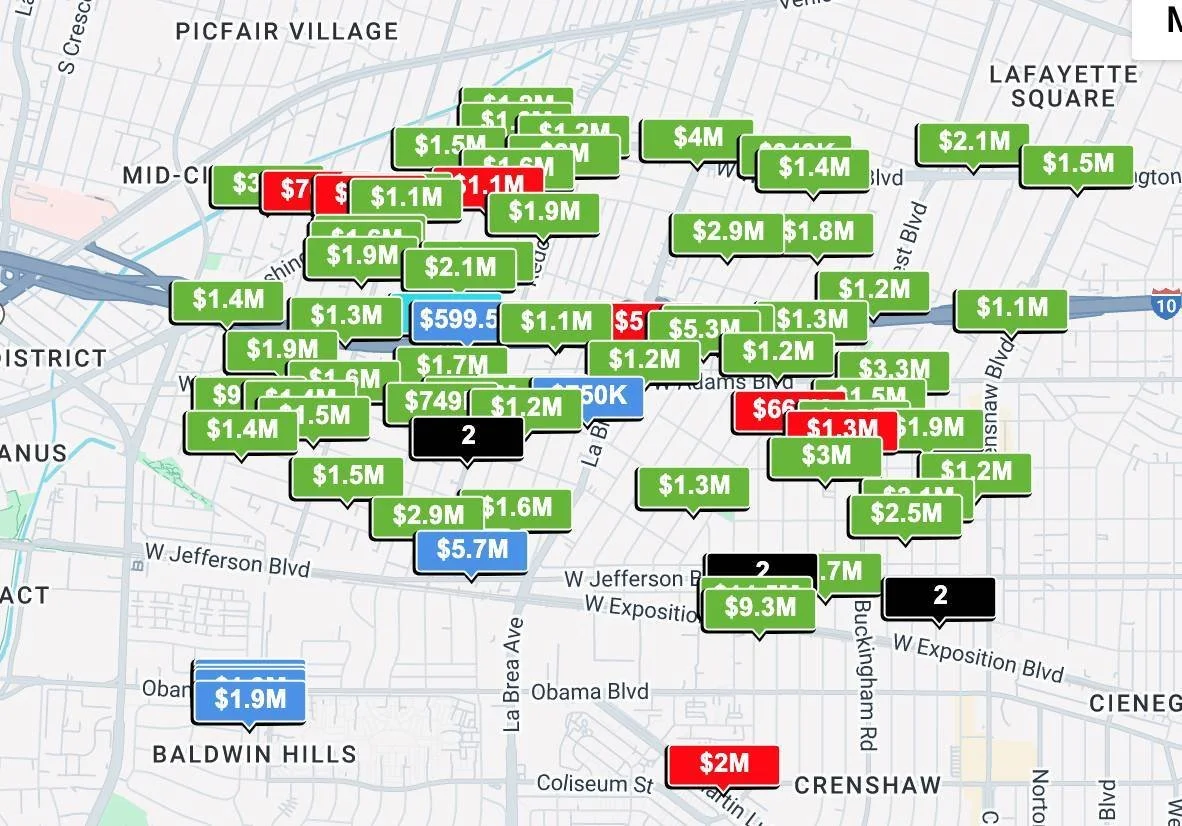

Multifamily Market Activity 90016

Active Listings: 63

Pending 10

Sold (past six months): 7

While the number of sales in the last six months is relatively low, the limited turnover highlights a market where owners tend to hold properties long-term, and available inventory draws close attention from investors.

What’s Selling in 90016 Multi-Units

Only seven sales have closed in the past six months, but they illustrate the demand patterns in 90016:

Entry-Level Duplexes: Lower-priced multifamily assets (often under $1.2M) sell the fastest, particularly those with stable rents or light renovation potential.

Mid-Range 4-Plexes and Small Buildings: Properties between $1.3M and $2.0M can sell, but only when pricing aligns with rent rolls and GRMs. Buyers are scrutinizing income more closely given today’s financing environment.

Premium Properties: Sales above $2M are rare in 90016, and when they do happen, they’re typically tied to larger unit counts or redevelopment potential in prime corridors.

Key takeaway: Buyers are focusing on value and income stability, gravitating toward well-priced duplexes and smaller multifamily buildings that make sense both as cash-flow assets and long-term holds.

What’s Not Selling Multi-Units in 90016

The data shows a different story for actives:

Overpriced listings above $2M without strong rent rolls have been sitting on the market for extended periods.

High GRM or low cap rate deals are not moving unless the property offers redevelopment angles or is located in a prime block of Lafayette Square or Jefferson Park.

Stale inventory risks turning off investors who are closely watching comps and waiting for price adjustments.

Pending Activity Apartment Buildings 90016

With 10 properties in escrow, the majority are priced between $1.1M and $1.6M. Investors are clearly focused on deals where income potential matches pricing, and where upside through renovations or ADUs exists.

Days on Market Trends Multifamily 90016

Quick Movers: Duplexes and smaller buildings priced right under $1.3M can close in under 30 days.

Moderate Pace: 4-plexes with decent income usually take 45–90 days.

Long Sitters: Overpriced properties with weak income potential sit well past 120 days, often requiring reductions.

Multifamily Real Estate in 90016: Pricing, Rental Demand, and Growth Potential

Investors are drawn to 90016 for several reasons:

Central location near Culver City, Koreatown, and Downtown LA

Strong tenant demand across working professionals, families, and students

Opportunity Zone designation in parts of the zip code, enhancing long-term returns

Historic architecture with ADU and value-add potential

Still, discipline rules the day. Cap rates and GRMs must support the price, and buyers are quick to pass on listings that don’t pencil out.

Final Thoughts

The 90016 multifamily and duplex market is active but selective. Investors are targeting well-priced properties in the $1.1M–$1.6M range while avoiding overpriced listings. Sellers need to remain realistic about rent rolls and pricing to avoid listings going stale. Buyers who act strategically in Opportunity Zone areas may see outsized long-term appreciation and after-tax gains.

Contact us today for a complimentary analysis and assessment of your multifamily property. Whether you’re selling a duplex, triplex, fourplex, 5+ units, or larger commercial space—or looking to buy, we deliver data-driven insights to help you maximize returns. Factors like zoning, value-add potential, proximity to Metro, and opportunity zone status all impact pricing. Numbers matter when selling multifamily and apartment buildings, and we’re here every step of the way to simplify the process and take the guesswork out of your transaction.