Key Real Estate Knowledge Every Home Buyer Should Have

What is Affordability?

This is determined by whether your income is sufficient to qualify for a home loan, factoring in the most recent data on home prices, revenue, and mortgage rates. Higher home prices and mortgage rates can affect how affordable a home is. Even 1 percentage point can make a huge difference when buying. It can save you hundreds of thousands of dollars based on the purchase price.

What is Appraisal?

This is a report from a qualified third party hired by the lender to determine a property's value estimate. Lenders use appraisals to confirm a home’s worth and to ensure they're not lending more than what the house is valued at. If a home's appraisal falls short of the purchase price, the bank will finance only up to the appraised value, requiring you to make up any shortfall. For instance, on a property with an expected loan amount of one million dollars that appraises at $950,000, you'd be responsible for the $50,000 difference; you may negotiate a price reduction or find a happy compromise with the seller. Lacking the funds or failing to renegotiate may lead you to invoke the appraisal contingency to withdraw from the purchase. In hot markets, sellers might request waiving.

What Are Buyer Closing Costs?

These fees are necessary to finalize a real estate transaction and are paid at closing. You can ask your lender for a detailed list of these costs, including points, taxes, and title insurance, or you can contact us to get a net sheet from escrow.

Prospective home buyers in Los Angeles should be prepared for closing costs ranging from 2% to 5% of the property's purchase price. These costs can vary based on the property type, such as a condo, multi-unit building, or estate. The costs can also vary based on the lender's terms, the sale price, and specific conditions related to the transaction.

The significant components of buyer closing costs in Los Angeles include:

Mortgage origination fees

Pre-paid mortgage interest

Appraisal fees

Property taxes

Escrow fees

Buyers may also have to pay for general home inspection, termite, sewer, and mold inspections. If further issues are discovered during these inspections, additional specialist evaluations, such as those from electricians, roofers, or HVAC technicians, may be required, incurring extra costs.

What Credit Score Do I Need to Qualify For A Loan?

This number ranges from 300 to 850 based on your credit history. Lenders use it to gauge the likelihood of you repaying debts in the future. For example, your FICO score could be as low as 580 for an FHA loan.

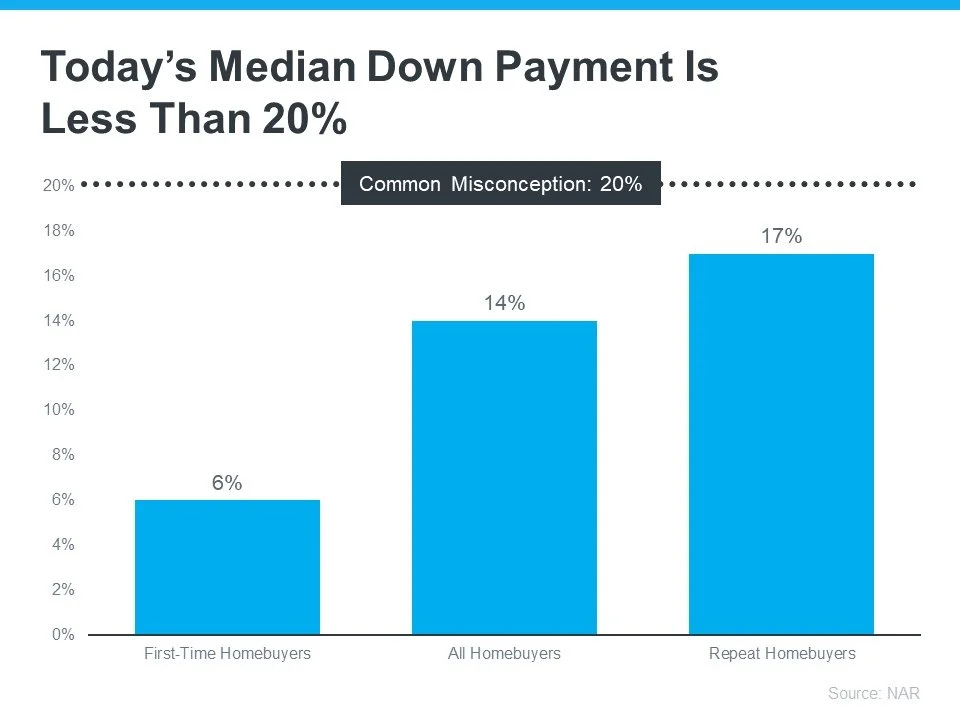

What is a typical Down Payment?

Typically, this is 3–20% of the home's purchase price. Some programs offer 0% down and 3% down payments. According to the latest Homeownership index from Down Payment Resource, there are over 2,000 homebuyer assistance programs in the U.S., and most are intended to help with down payments. Loan types, like FHA loans, have down payments as low as 3.5%, and there are options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, please do your homework. If you want to learn more about down payment assistance programs, information is available through sites down payment resources in your state. Then, partner with a trusted lender to know what you qualify for on your home-buying journey.

According to Freddie Mac:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

What is an Inspection Contingency?

This contract term requires a home inspection to be carried out, providing details on the condition of the home and any necessary repairs during escrow, also known as the buyer’s due diligence period. When buying a property, whether a multi-family unit or a single-family home, hire a general home inspector for a comprehensive evaluation, including termite, mold, and sewer inspections, which are standard initial checks. Condos will require fewer inspections since HOA is responsible, for example, for sewer and roofing. If they uncover electrical systems or plumbing issues, it's advisable to engage specialists in those fields for a detailed assessment, ensuring complete satisfaction with all aspects of the property. Additionally, consulting the local city's website for permits and violations is crucial in the due diligence process.

Suppose you encounter any issues during the home inspection, such as a worn-out roof, faulty HVAC, broken clay in the sewer system, foundation problems, or other areas of concern. In that case, you can negotiate with the seller to address them. Your real estate advisor will be able to help you in this process, helping you figure out which repairs, if any, should be fixed before finalizing the purchase. Conducting a thorough inspection is essential as it reveals potential problems that could become costly for you as the new homeowner.

According to the American Society of Home Inspectors states:

“Home inspections are the opportunity to discover major defects that were not apparent at a buyer’s showing. . . . Your home inspection is to help you make an informed decision about the house, including its condition.”

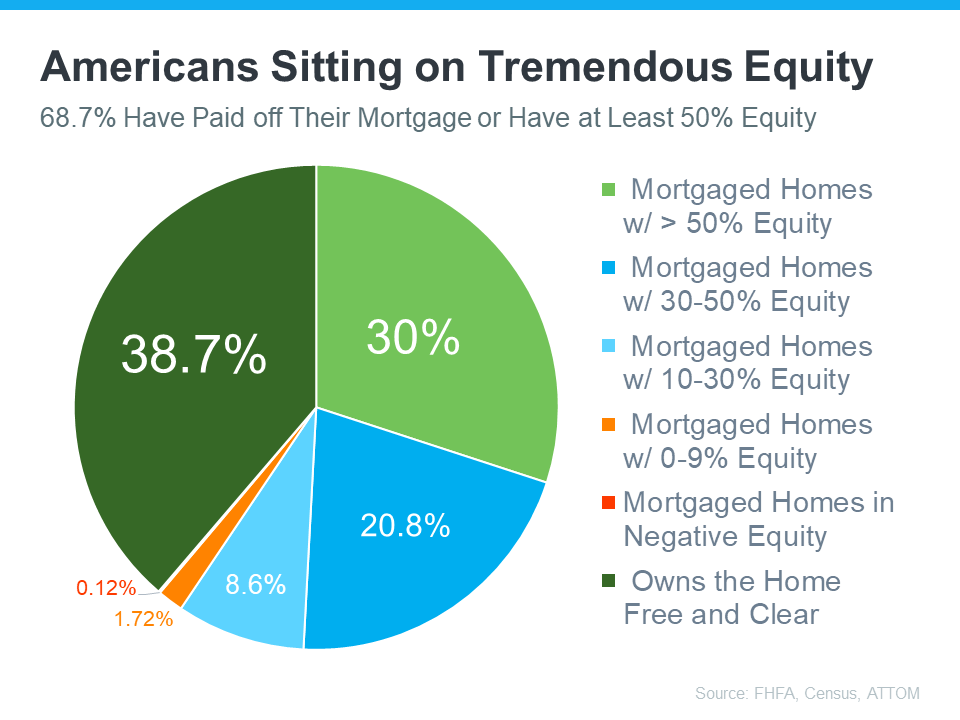

What is Equity?

This is the value of your home minus any debts it secures. Many homeowners find they have more equity than they thought, which they can use to facilitate a move. The housing market has gained tremendous equity during the pandemic, and Americans are sitting a ton of equity.

According to Bankrate:

“Home equity is the portion of your home that you’ve paid off and own outright. It’s the difference between what the home is worth and how much is still owed on your mortgage. As your home’s value increases over the long term and you pay down the principal on the mortgage, your equity stake grows.”

What is a Mortgage?

A mortgage is a loan to purchase a home, condo, multi-unit, or real estate property. The buyer pays back the lender over time with interest, while the property serves as security for the loan. If the buyer fails to repay, the lender can take possession of the property. Mortgages come in different types, such as fixed-rate or adjustable-rate, depending on the interest and repayment terms. Essentially, a mortgage is a loan taken out using your home as collateral to buy the property, with the mortgage amount being the home's purchase price minus the down payment.

What is A Mortgage Rate?

When you take a mortgage to buy a house, you need to pay a yearly fee to the lender to let you use their money, which is called the mortgage rate. It is expressed as a percentage and can remain fixed or vary depending on specific financial standards. Your credit score determines the mortgage rate you get, the amount you pay upfront, and the loan's value compared to the home's price. The mortgage rates can be affected by the economy's health, inflation, and other significant factors. If you plan on buying a home, it is crucial to learn about mortgage rates as they affect the interest you pay over time. Hence, it is essential to speak with a lender to understand how fluctuations in mortgage rates can impact your monthly mortgage payments.

What is A Pre-Approval Letter?

Power of Pre-approval letter

A pre-approval letter is like a lender's green light indicating their willingness to lend you a certain amount of money to buy a house. It is not a promise but rather an indication that the lender will likely lend to you after checking your financial background, including a credit check. This letter acts like a VIP pass when you're house hunting, demonstrating to sellers that you are serious and have the financial backing to purchase. To get this letter, you'll need to share your financial details with the lender so that they can figure out how much you can safely spend. This is a crucial step in home-buying as it helps you understand how much you can afford and makes sellers more willing to negotiate. Essentially, it is a document from a lender that states the amount they are ready to lend you for a home loan. This and your savings can help you determine your home purchase budget.

The Meaning Behind Underwritten and Fully Approved Loans

Underwriting is the process where a financial expert, known as an underwriter, checks a borrower's income, assets, debts, credit score, and property details to grant final approval for a loan. This step is crucial as the underwriter evaluates the borrower's financial health to decide how likely they are to repay the loan, essentially determining the risk of lending to them.

Pre-Approval vs. Full Approval

Pre-Approval: This is like a quick check to see how much a loan you might get based on your credit. It's an early thumbs-up that you could borrow money. Underwritten Loan This goes deeper, looking closely at your money situation. It is more direction and a deeper evaluation of your loan. Don’t co-sign for someone or buy an expensive car in escrow; your loan cost gets denied.

Embarking on a home-buying journey can be challenging, but with the right approach, success is possible. The key to achieving this success is to keep your end goal in mind, which is to smoothly transition into escrow. To help you navigate this path like a pro, it's crucial to understand the intricacies of real estate contracts and master the terminology. As an informed buyer, you'll be empowered to make decisions that lead to successful outcomes.

To unlock your potential as a buyer, we offer a complimentary buyer's consultation. Our team is here to guide you every step of the way and help you deepen your knowledge of the home-buying process. Education is essential to achieving your goals in real estate, and we're committed to helping you lay the foundation for success. Connect with us today to schedule your consultation and prepare for a rewarding home-buying experience.